Weaker Yen and the Japanese economy

Posted on April 21, 2022 by Nikolay Alexandrov

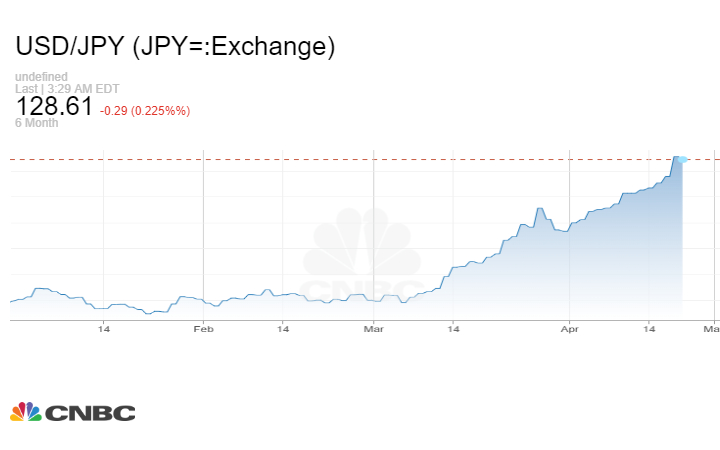

The Japanese yen (JPY) has been experiencing a freefall for the last few weeks amid the country’s dovish monetary policy and central banker’s Kuroda insistence that a weak yen is not harming the economy.

Japan’s top currency diplomat Masato Kanda said a weak yen has both merits and demerits for the economy due to the country’s changing export patterns and increasing reliance on imports.

The weakness of the Yen especially in the 80s and 90s was a cause for celebration for Japanese exporting companies that could sell cars and electronics cheaper in foreign markets and experienced bigger profitability when earnings were brought back home. Around two-thirds of the automobiles produced by Japanese manufacturers are now made abroad, according to Reuters calculations based on data from the “Japan Automobile Manufacturers Association”.

The demerits side according to Kanda is that the weakness in the yen has driven up the cost of fuel and other commodities for manufacturers at home. Additionally, it is also hurting household spending and consumer confidence in the domestic market.

The yen’s solid status was mainly supported based on the fact that Japan has been the world’s largest net creditor and benefited from massive current account surpluses thanks to a flow of income from overseas, including returns on investments. Consequently, the yen has been, and it is still widely accepted as a “safe-haven” currency, meaning that in times of high market uncertainty and elevated risk, foreign exchange investors tend to park their funds towards the yen for safe returns.

However, due to the structural change in Japan’s trade balance, concerns are growing that the country may even post an annual current account deficit. Because of the increasing red ink in the trade arena, Japan posted a current account deficit in December and January. Although February posted a ¥1.64 trillion current account surplus, the figure was still down by 42.5% year on year.

Economists said that the current global economic landscape is vastly different due to the Russia-Ukraine conflict and the ongoing pandemic, which are diminishing some of the benefits of a depreciated yen. Economists also warned that a weakness in the yen is expected to last for some time, as the BOJ appears to be insisting to its dovish stance even though hawkish central banks in other nations are set to raise interest rates to contain inflation.

The manufacturing industry has been experiencing pandemic-related supply constraints, such as those over semiconductors. Major Japanese automakers have been forced to cut production and reduce their exports.

BOJ Governor Haruhiko Kuroda said recently that the yen’s latest moves had been “quite sharp” and could hurt companies’ business plans, offering his strongest warning yet of the risks arising from the currency’s drop. Kuroda, however, repeated his view the BOJ must stay firm to its massive stimulus program to support economic recovery. Nevertheless, the IMF has revised Japan’s 2022 growth forecast to 2.4% from 3.3%. for 2022 warning for “spillover” risks citing the Ukraine war.

If a weak yen is going to persist, the question is: Will the Bank of Japan react to counter the trend? Or will the USD/Yen be left to a freefall beyond ¥130.00?

Sources

capital.com, cnbc.com, reuters.com, japantimes.co.jp.

*Disclaimer: The information contained in this publication does not constitute investment advice and is not a personal recommendation from NaxexInvest. Nothing contained herein constitutes the solicitation of the purchase or sale of type of financial instrument. Any investment activities undertaken using this information will be at the sole risk of the relevant investor. NaxexInvest expressly disclaims all liability for the use or interpretation (whether by visitor or by others) of information contained herein. Decisions based on this information are the sole responsibility of the relevant investor. Any visitor to this page agrees to hold NaxexInvest and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information.