Market Outlook Week 26-30 June

Posted on July 7, 2023 by Nikolay Alexandrov

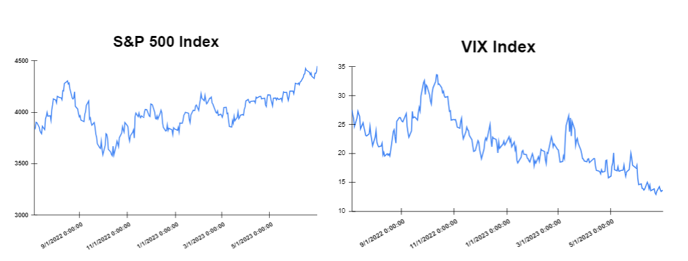

Global markets finished the week higher

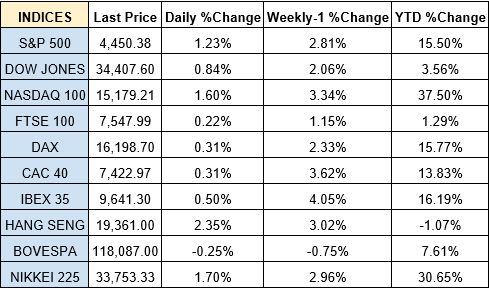

The global markets started the week mostly lower. On Monday, a survey showed that the business climate in Germany continued to deteriorate in June. The business climate index fell to 88.5, down from 91.7 in May and lower than forecasts suggested. On Tuesday, the markets closed on positive territory, as several economic releases, like durable goods orders, consumer confidence, and new home sales, all came in better than expected. On Wednesday, the European markets closed higher with the ECB President Christine Lagarde reaffirming further rate hikes lie ahead. Furthermore, Federal Reserve Chair Jerome Powell continued to insist that further rate hikes likely lie ahead. On Thursday, Germany’s annual rate of consumer inflation accelerated in June compared to the previous month to reach a higher-than-expected 6.4%. Furthermore, annual inflation in Spain stood at 1.9% in June, down from 3.2% in the previous month. Meanwhile, the United States gross domestic product (GDP) increased by 2% in the first quarter, higher than estimates and the weekly jobless claims fell to 239,000, lower than expected. Following the above news, the global market closed broadly higher on Thursday. On Friday the European markets closed with strong gains after annual inflation in the euro area ran at 5.5% in June, down from last month’s figure of 6.1%. Moreover, on the same day, the UK’s gross domestic product (GDP) came in in-line with initial projections, growing by 0.1% during the opening quarter of 2023, while the US personal consumption expenditure (PCE) inflation metrics came in also in-line with expectations for the month of May. Finally, the global stock markets ended the week higher, after a week full of important economic data and financial updates. The Dow Jones closed with a gain of 0.84% at the closing bell on Friday. The S&P rose by 1.23%. Furthermore, the DAX increased by 1.26% and the CAC 40 jumped by 1.19%. The FTSE 100 increased by 0.80%.

In addition, investors are looking forward to the Europe inflation (CPI) data expecting a decrease to 5.6% from 6.1%.

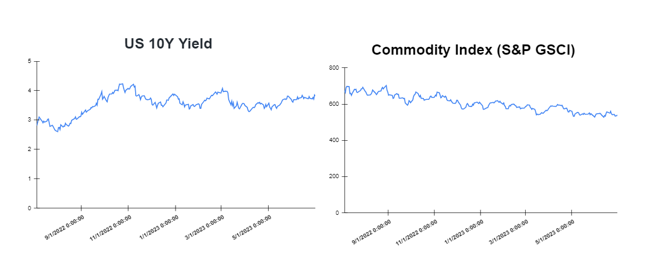

Treasury yields were mixed towards the end of the week

Yields started the week lower as investors awaited commentary from Federal Reserve speakers. However, yields moved up on Thursday after the stronger-than-expected economic data, which showed that the Fed will keep interest rates higher for longer. On Friday, yields closed the week mixed as the latest personal consumption expenditure price index data showed signs of easing inflation. Specifically, on Friday, the yield on the 2-year Treasury increased to 4.902%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.841%, declining by about 1 basis point. The 30-year Treasury yield, which is key for mortgage rates, hit 3.8540%. The spread between the US 2’s and 10’s advanced to -106.1bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) advanced to – 145.5 bps. In addition, investors are looking forward to the US Nonfarm Payrolls report on Friday, 7 of July, in which a decreased of 114K is expected.

Volatile week for USD

The US Dollar at the start of the week was lower as investors await new data and speeches from central bankers from the European Central Bank (ECB). In the middle of the week the US Dollar advanced as Powell hinted at several more rate hikes from the Fed over the summer. However, on Friday, the US dollar finished lower after economic data showed a cooling in consumer spending, raising some doubt about the potential aggressiveness of the Federal Reserve in fighting inflation. The EURUSD increased to 1.0911, while the GBPUSD increased to 1.2695. Additionally, the USDJPY decreased to 144.26 Yen on Friday.

Oil and Gold traded higher towards the end of the week

Gold started the week higher as investors looked for safer bets after the turmoil in Russia over the weekend which sparked new geopolitical concerns. However, Gold traded higher at the end of the week following the soft Personal Consumer Expenditures from the US, which fuelled a decline in US yields and, thereby, a weaker US Dollar, which boosted the yellow metal. On the other hand, oil prices for front-month deliveries climbed over 1% on Monday after OPEC Secretary General Haitham Al Ghais revealed that the commodity demand is expected to expand by 23% to 110 million barrels per day by 2045. Also, oil continued to move higher at the end of the week, after softer U.S. inflation data suggested that the Federal Reserve could be a little restrained in its hawkish talk to rein in price growth via rate hikes. Meanwhile, the Crude Oil Inventories report will be released on Wednesday which is expected to show an increase of 8.874M.

Stock indices performance

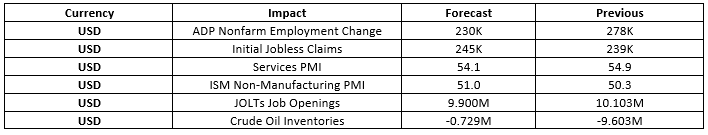

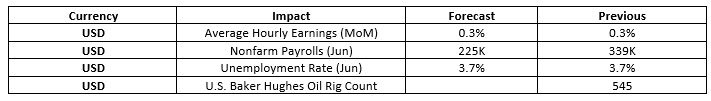

Key weekly events:

Key weekly events:

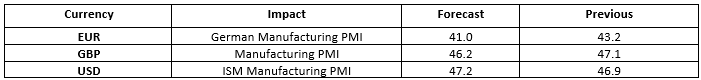

Monday – 03 July 2023

Tuesday – 04 July 2023

Wednesday – 05 July 2023

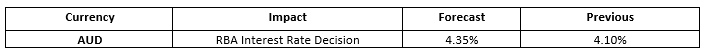

Thursday – 06 July 2023

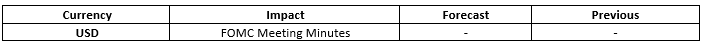

Friday – 07 July 2023

Sources:

Sources:

https://www.tradingview.com/

https://breakingthenews.net/Home

https://www.investing.com/

https://www.fxstreet.com/news

https://www.cnbc.com/world/