Market Outlook Week 06-10 March

Posted on March 14, 2023 by Nikolay Alexandrov

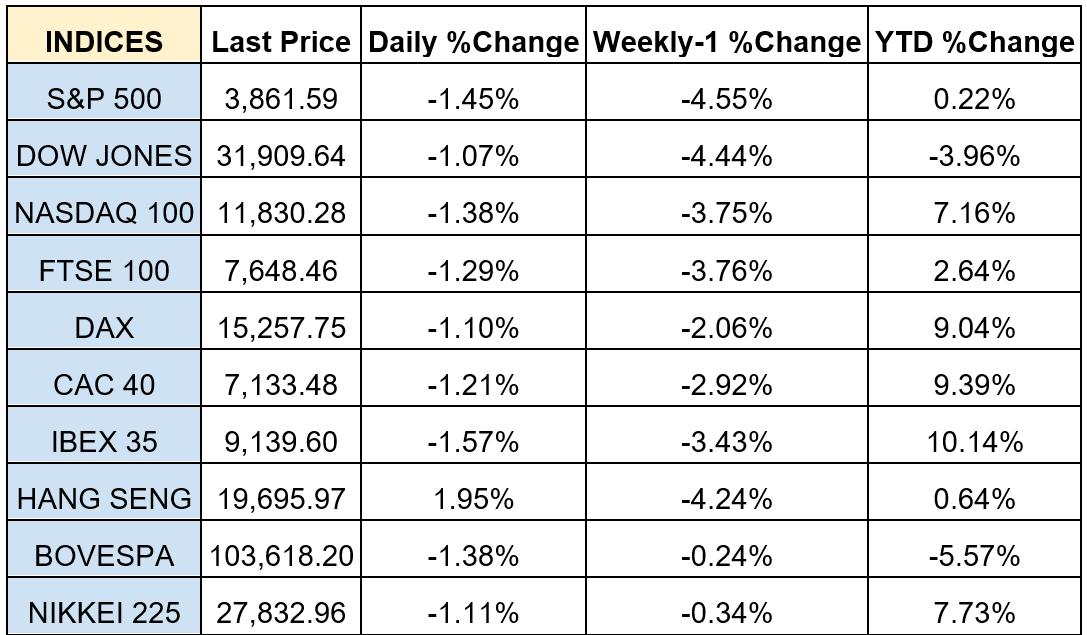

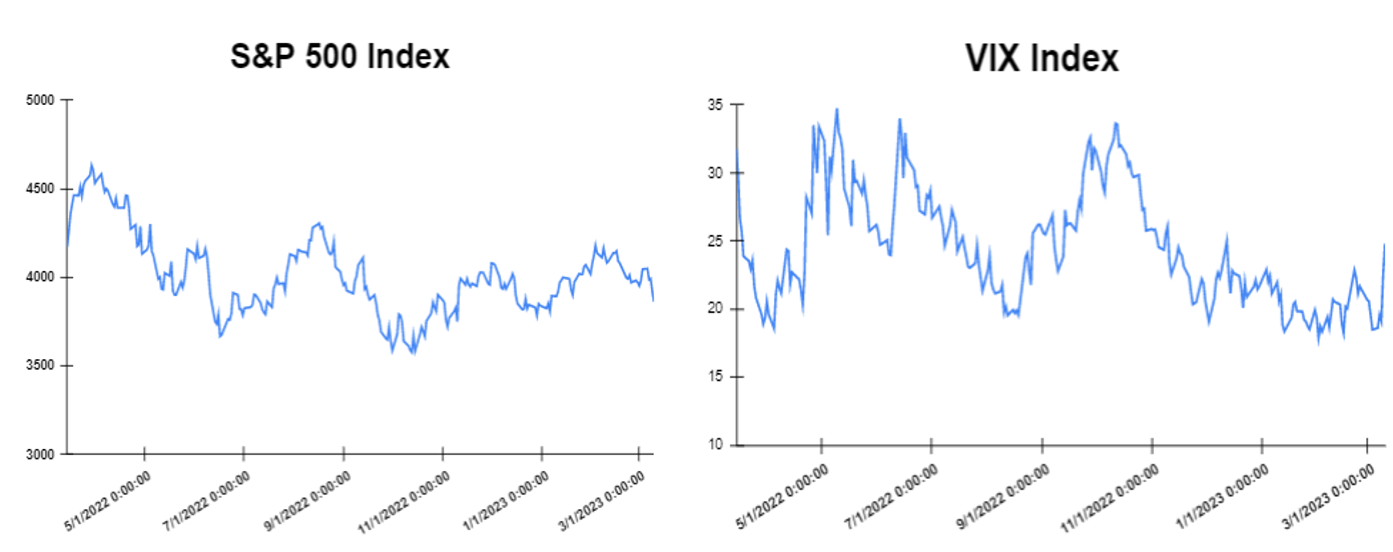

Global markets finished the week lower

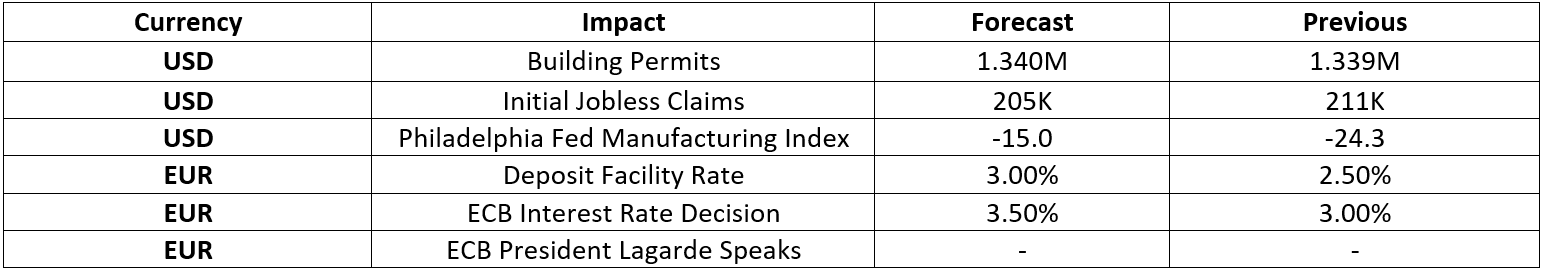

Global markets started the week mixed as investors digested the latest batch of economic data in Europe, which sent mixed signals about the state of the continent’s economy. On Tuesday markets moved sharply lower (S&P dropped by 1.5%) after Federal Reserve Chair Jerome Powel warned that the central bank will likely have to increase its key interest rates higher than policymakers initially expected because latest economic data have come stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. Moreover, initial jobless claims in the United States on Thursday, increased higher than expected by 21,000 to reach 211,000 in the week ending March 3, raising hopes that a softening labor market will reduce the likelihood of the Federal Reserve reaccelerating the pace of its rate hikes. However, the nonfarm payroll employment in the United States increased to 311,000 in February, well above the expectation of 215,000, which demonstrates the strength of the labor market. In other news, it was confirmed on Friday morning that the Silicon Valley Bank (SVB) was shut down as it was not able to raise capital to boost its finances, causing regulators to take possession of the bank. As a result, the stock markets moved sharply lower. Specifically, the Dow Jones dropped by 1.07% at the closing bell on Friday. The S&P further 500 declined by 1.45%. Furthermore, the DAX sank by 1.64%, CAC 40 tumbled by 1.30% and the FTSE 100 dropped by 1.67%. In addition, investors are looking forward to European Central Bank interest rates decision in which an increase to 3.50% from 3.00% is expected.

Treasury yields declined towards the end of the week

Yields significantly declined on Friday after new jobs data showed thatthe unemployment rate rose by 0.2% points to 3.6 signalling that the labor market may be cooling off. Also, this decline is due to investors increasing their demand for bonds which are seen as a safe-haven asset, after this uncertainty and the potential economic slowdown. On Friday, the yield on the 2-year Treasury decreased to 4.738%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.81%, down by about 11.3 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 3.804%. The spread between the US 2’s and 10’s widened to -92.8bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) widened to – 127.6bps.

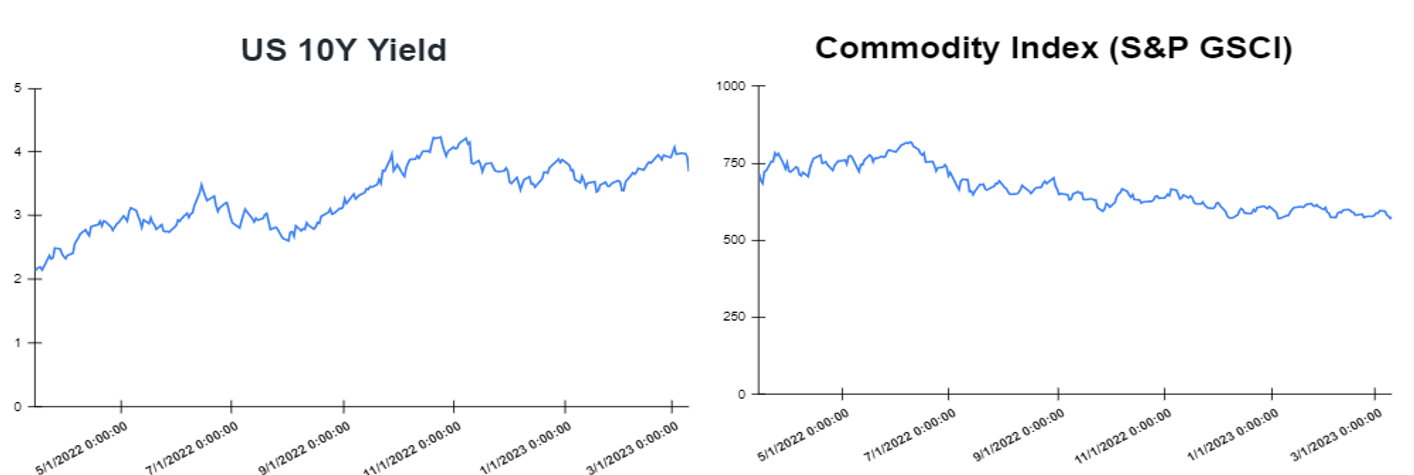

Volatile week for USD

The US Dollar fell after the US employment report, which showed a slower wage growth and a rise in the unemployment rate to 3.6%. The EURUSD rose ny 0.57% to 1.0650, while the GBPUSD rose ended the week higher at 1.2040 (up by 0.83%). Additionally, the USDJPY fell to 135.022 yen on Friday after the Bank of Japan kept its policy rate, the Yield Curve Control parameters and guidance unchanged. Furthermore, the USDCHF suffered the worst weekly loss since November (-1.5%) and the USDCAD gained over 200 pips over the week, posting above 1.3800, the second-highest weekly close since May 2020.

Oil and Gold traded higher towards the end of the week

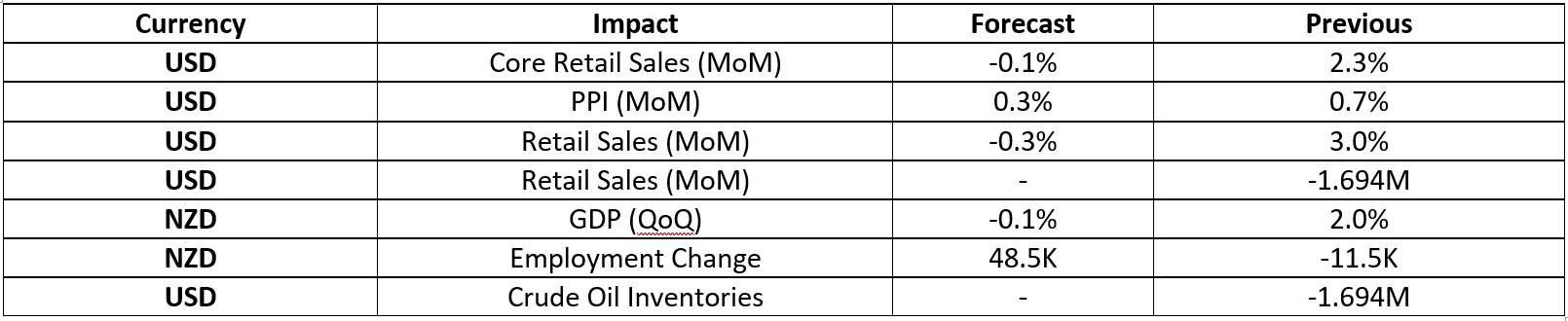

Gold started the week lower as the investors prepared for Congressional testimony from Federal Reserve Chair Jerome Powell this week and monthly U.S. jobs data, both of which could influence interest rate policy. Gold traded higher at the end of the week after better-than-expected nonfarm payrolls jobs report, which showed that the US added 311,000 jobs in February, while the unemployment rate unexpectedly rose by 0.2 percentage points to 3.6%. Prices of Oil moved lower at the start of the week, as investors worry about a potential recession and a reduce future oil demand. However, on Friday, the prices of oil futures gained as optimism about increased demand in the United States grew. Meanwhile, the Crude Oil Inventories report will be released on Wednesday.

Stock indices performance

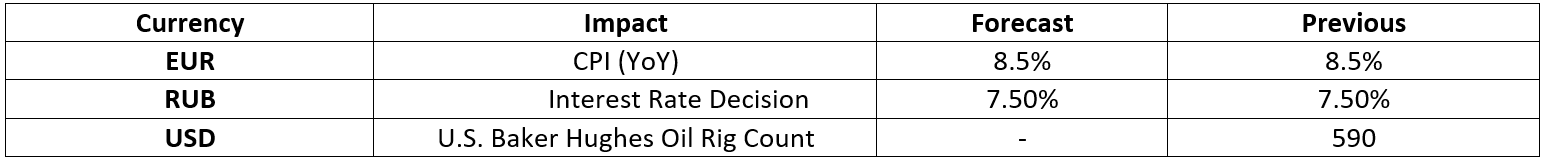

Key weekly events:

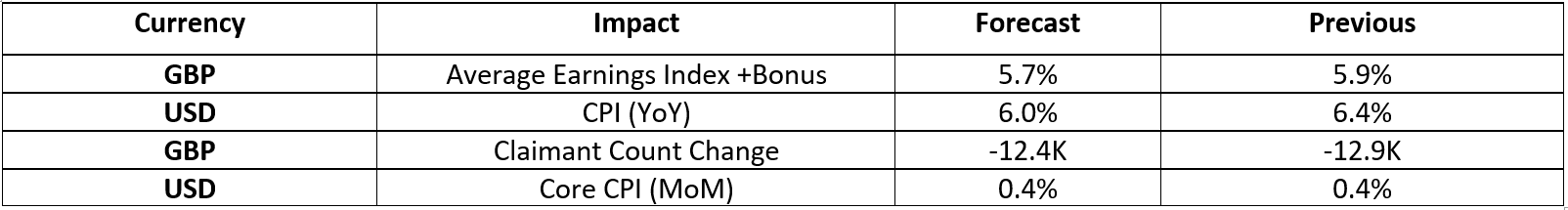

Tuesday – 14 March 2023

Wednesday – 15 March 2023

Thursday – 16 March 2023

Friday – 17 March 2023

Sources: