Market Outlook Week 06-10 February

Posted on February 17, 2023 by Nikolay Alexandrov

Global markets finished the week mix.

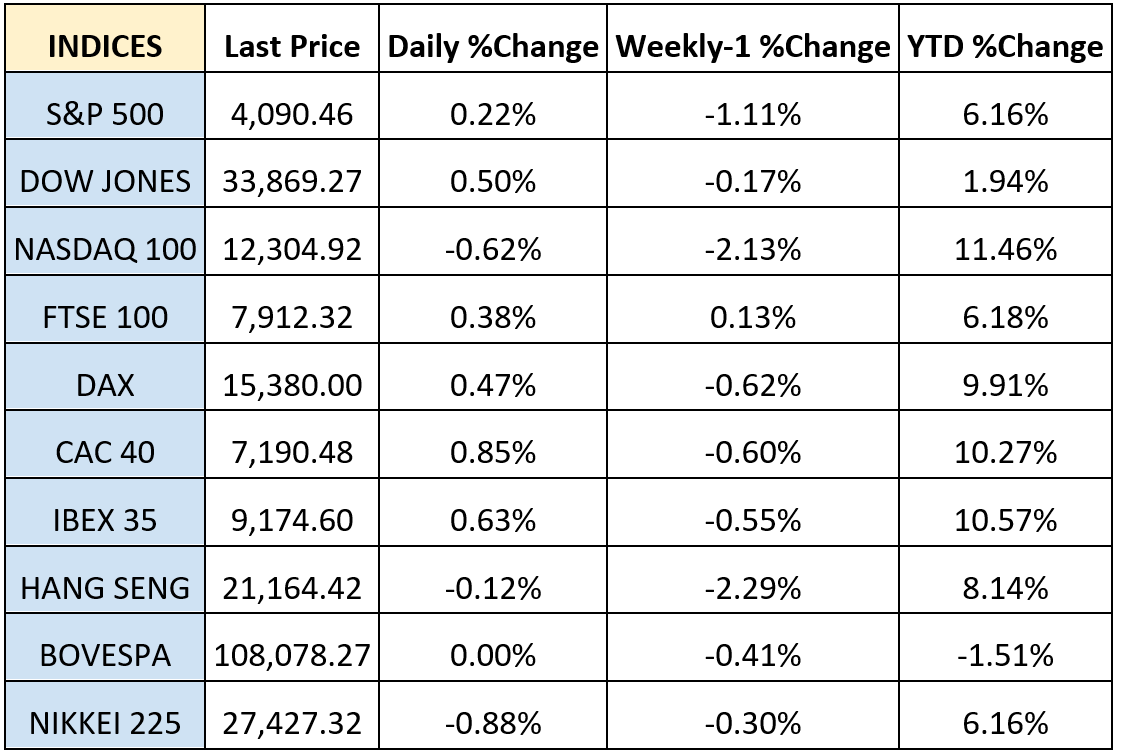

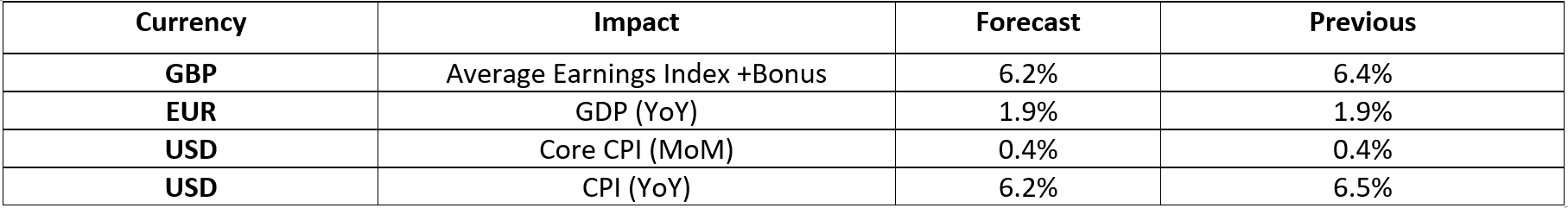

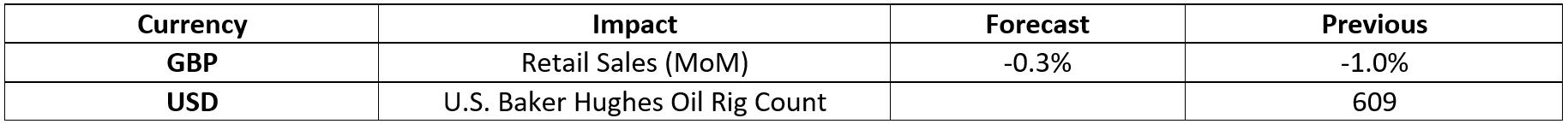

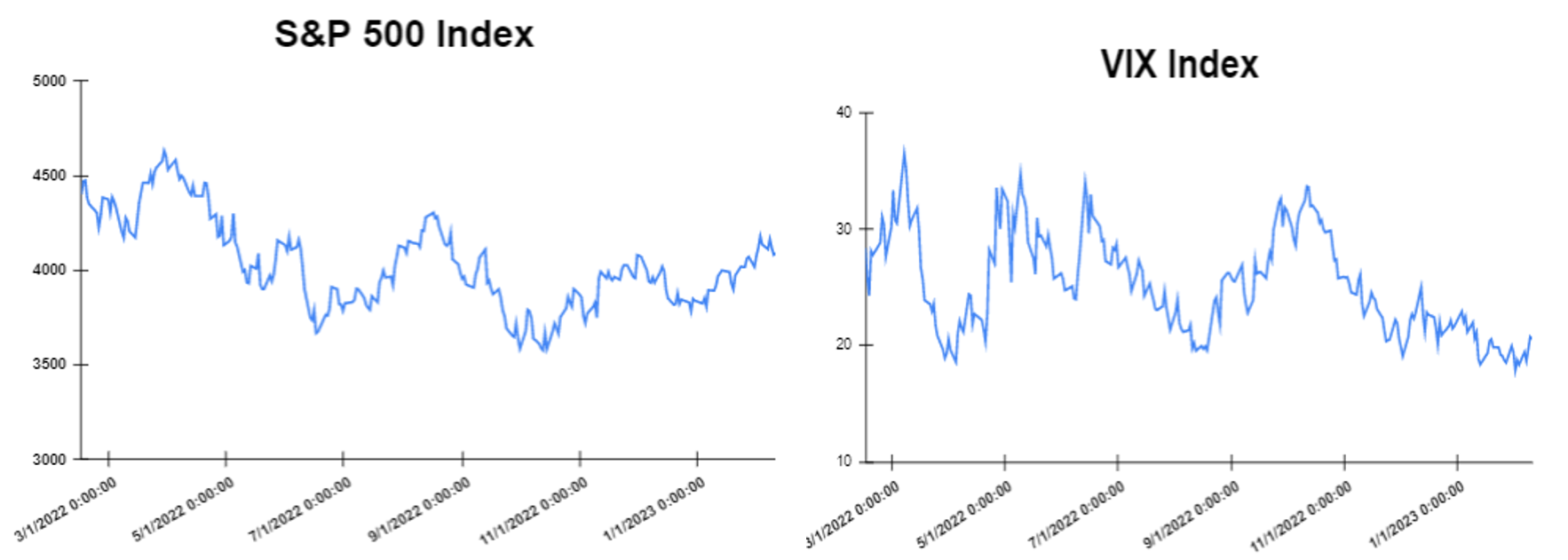

Global markets started the week lower. Euro Retail sales decreased by 2.8% year-on-year in December, a third consecutive drop, and slightly worse than market forecasts of a 2.7% decline. Investors were still concerned over the FED future interest rates increases. However, the markets have been taking some encouragement off recent remarks from Fed Chairman Jerome Powell, who has said that he is seeing disinflationary signs. Moreover, on Thursday US market was lower after higher-than-expected initial jobless claims. Initial jobless claims in the United States rose by 13,000 to 196,000 in the week ending February 4. The Dow Jones increased by 0.50% at the closing bell on Friday. The S&P 500 gained by 0.22%. Furthermore, the DAX fell by 1.39%, CAC 40 declined by 0.88% and the FTSE 100 retreated by 0.36%. In addition, investors are looking forward for inflation data for GBP and USA on Tuesday and Wednesday on which a decrease for both is expected.

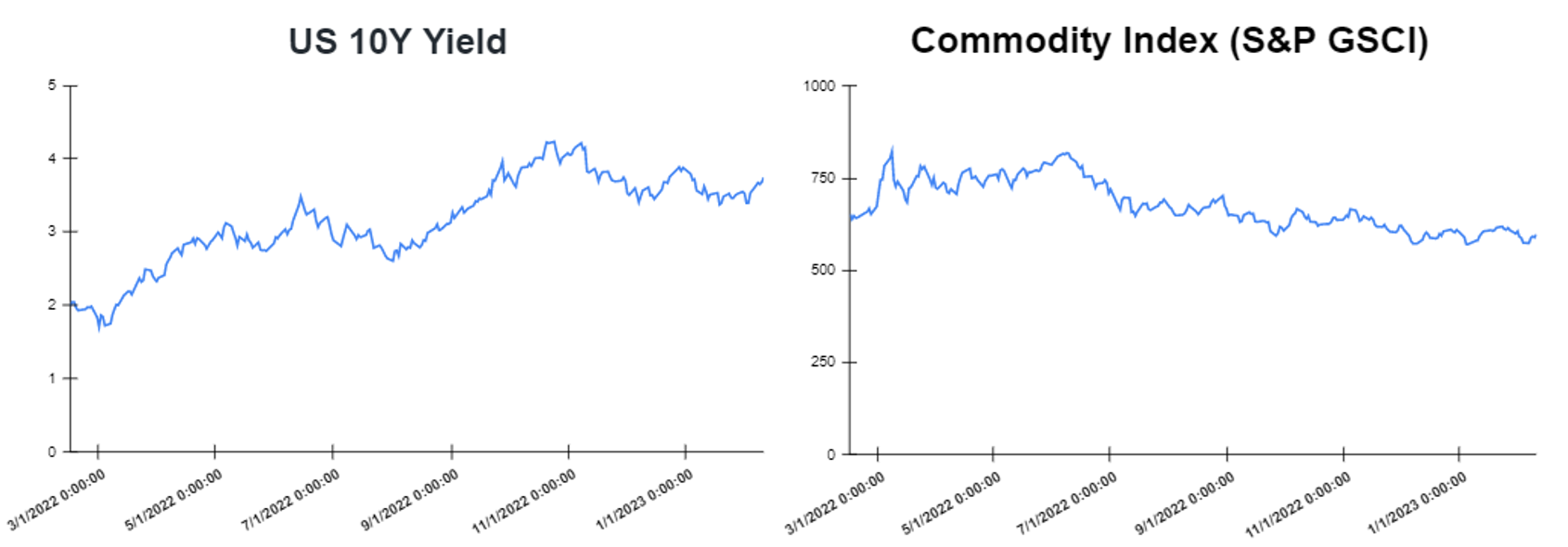

Treasury yields advanced towards the end of the week.

Yields advanced after a better-than-expected consumer confidence, in which there was an increase by 2.3% on a monthly basis to 66.4 points in February. The yield on the 2-year Treasury increased to 4.53%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.745%, up by about 6 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 3.823%. The spread between the US 2’s and 10’s tightened to -70.7bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) widened to – 138.9bps.

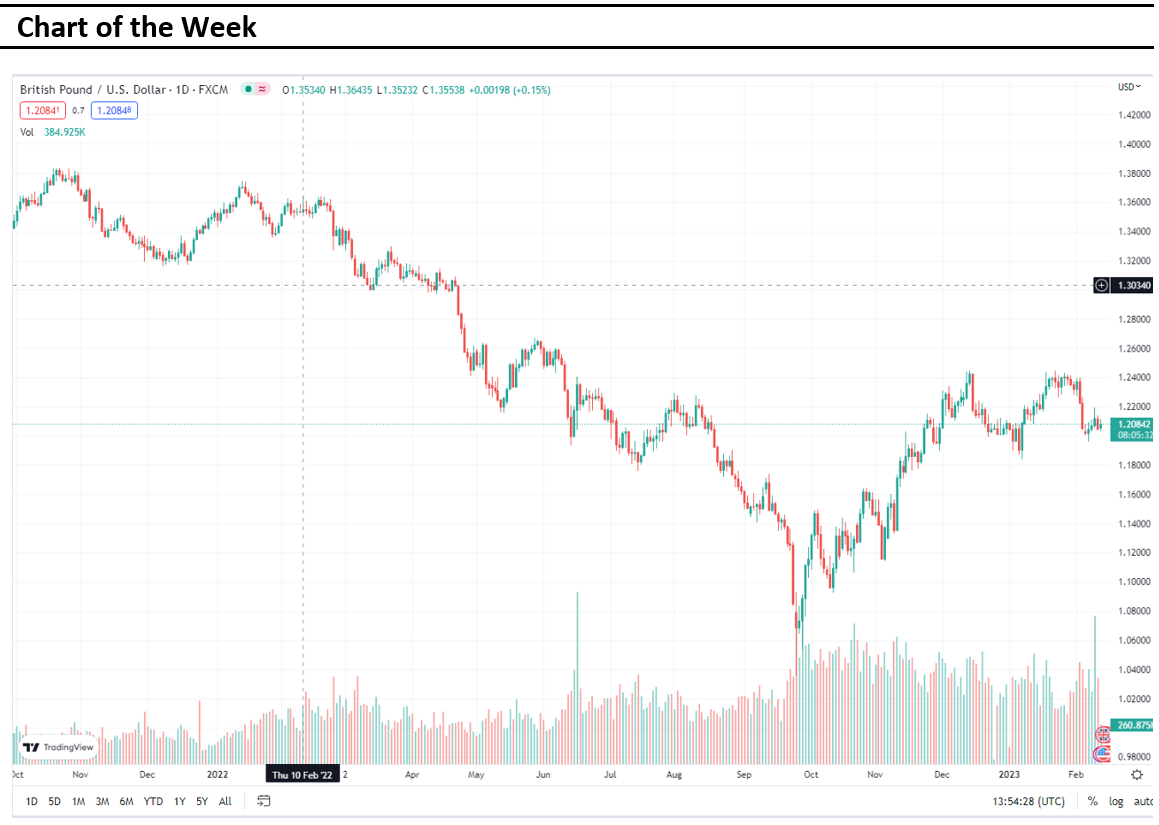

Volatile week for USD.

The US Dollar moved higher towards the end of the week after investors concerns about US inflation reports next week. The EURUSD fell by 0.2% on Friday to 1.0777 despite German industrial orders rising by a larger than expected 3.2% in the month in December. The GBPUSD fell by 0.1% to 1.2040, having touched a one-month low of 1.2031 earlier on Monday. The UK economy stagnated in the fourth quarter as expected. On a monthly basis, the Gross Domestic Product contracted by 0.5%. Moreover, the AUDUSD rose by 0.1% to 0.6924, NZDUSD fell by 0.2% to 0.6320, while USDCNY rose by 0.1% to 6.7806, with the yuan weakening on the rising political tensions with the U.S.

Oil and Gold traded opposite towards the end of the week.

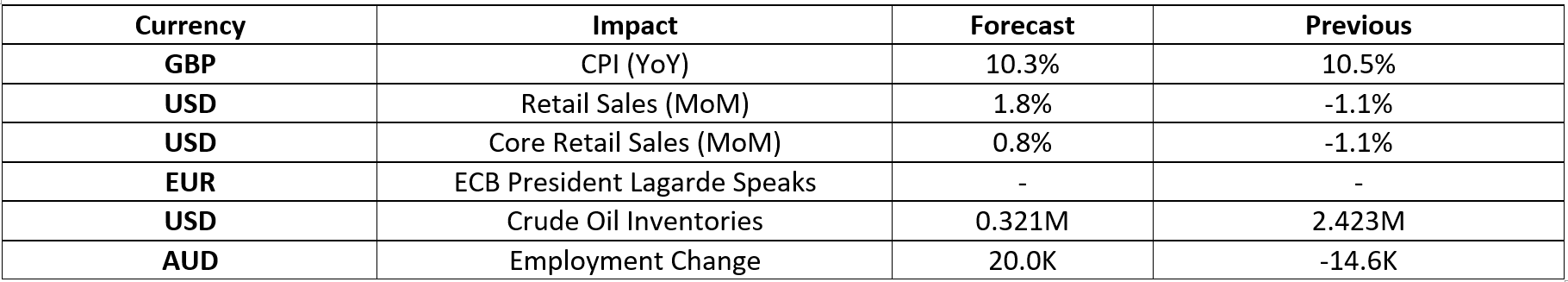

Gold started the week lower after fears that the FED would continue to keep raising interest rates. However, Gold traded lower at the end of the week after a rising form short-term yields. Prices of Oil moved higher at the start of the week, as European Union put embargo on Russian refined petroleum products imports. However, Oil traded higher in the middle of the week after crude oil inventories in the United States increased by 2.4 million barrels to 455.1 million barrels in the week ending February 3. In addition, on Friday, the prices of oil futures rose following news that Russia plans to cut oil production by 500,000 barrels per day in March. Meanwhile, the Crude Oil Inventories report will be released on Wednesday which is expected to show a decrease by 2.102M.

Stock indices performance

Key weekly events:

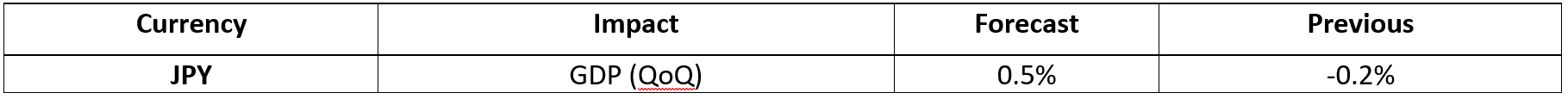

Monday- 13 February 2023

Tuesday – 14 February 2023

Wednesday – 15 February 2023

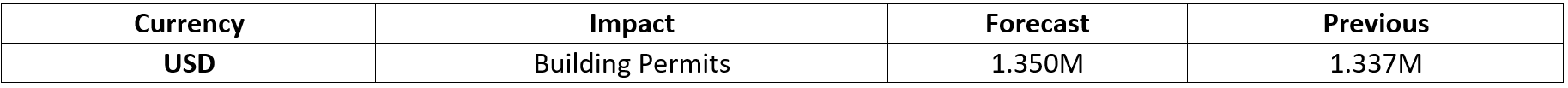

Thursday – 16 February 2023

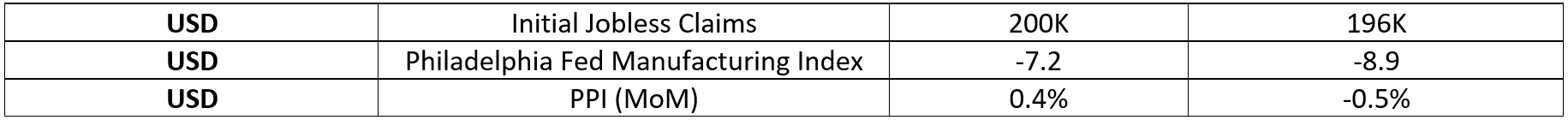

Friday – 17 February 2023

Sources: