Market Outlook Week 12-16 June

Posted on June 23, 2023 by Nikolay Alexandrov

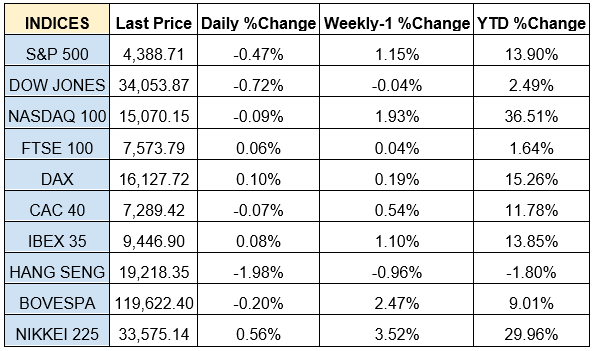

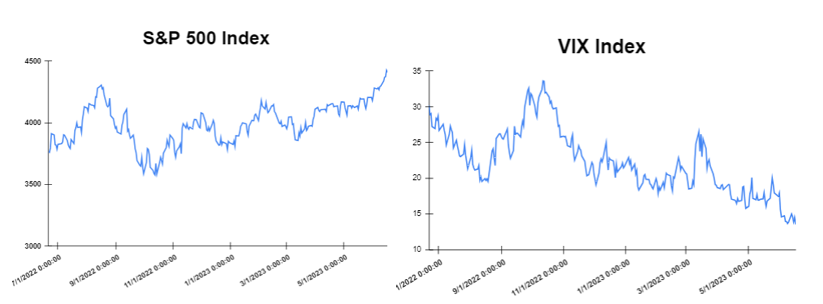

Global markets finished the week mixed

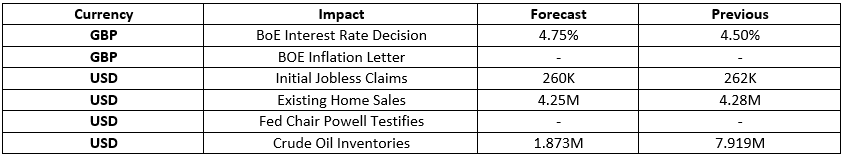

The global markets started the week higher, as investors were waiting for the reports on inflation in Germany, but also in the United States, and unemployment in the United Kingdom. Moreover, on Tuesday, Consumer prices in Germany rose to 6.1% in May as expected compared to the same month a year earlier but the figure marks a decline from April when inflation stood at 7.2%. Furthermore, the unemployment rate in the United Kingdom went up by 0.1 percentage point in the trimester to April compared to the previous quarter to land at 3.8%, marginally lower than market expectations. On the same day, the annual inflation in the United States came in at 4.0% in May, declining from the 4.9% registered in April and standing slightly lower than analysts predicted. On Wednesday, the United Kingdom’s gross domestic product (GDP) rose by 0.2% in April. According to the report, the GDP increased by 0.1% in the three months to April 2023. Furthermore, United States Federal Reserve’s Federal Open Market Committee (FOMC) announced on Wednesday that it has unanimously decided to suspend its interest rate increases in June, after 10 straight hikes, and leave the federal funds rate at 5.25%. Following the above news, the global market closed mix on Wednesday. The European Central Bank decided on Thursday to raise its three key interest rates for the eighth time in a row, this time by 25 basis points. Also, on the same day, the number of seasonally adjusted initial jobless claims in the United States remained unchanged at 262,000 in the week ending June 10. On Friday, the annual inflation in the euro area clocked in at 6.1% in May, while the monthly rate remained unchanged. Finally, the global stock markets ended the week mixed, after a week full of important economic data and financial updates. The Dow Jones closed with a loss of 0.32% at the closing bell on Friday. The S&P declined by 0.37%. Furthermore, the DAX rose by 0.54% and the CAC 40 increased by 1.34%. The FTSE 100 rose by 0.19%. In addition, investors are looking forward to the BoE Interest Rate Decision expecting an increase to 4.75% from 4.50%.

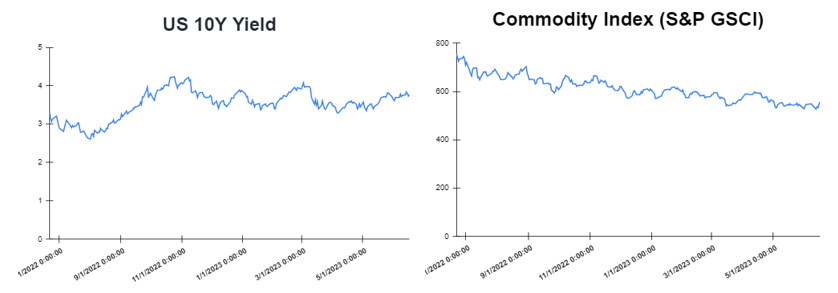

Treasury yields advanced towards the end of the week

Yields started the week lower as investors braced themselves for the latest inflation data and the Federal Reserve’s next policy meeting and interest rate decision. However, yields closed the week higher on Friday as investors considered the path ahead for interest rates and awaited data that could provide hints about the state of the economy. Specifically, on Friday, the yield on the 2-year Treasury increased to 4.720%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.769%, advanced by about 4 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 3.8560%. The spread between the US 2’s and 10’s advanced to -95.1bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) declined to – 134.8 bps.

Volatile week for USD

The US Dollar at the start of the week was higher as investors were waiting for upcoming important economic data. In the middle of the week the US Dollar declined as the Federal Reserve kept its interest rate unchanged. On Friday, the US dollar finished lower after having the worst week in months as US data showed that inflation continues to slow down. The EURUSD increased to 1.090, while the GBPUSD increased to 1.28 climbing for the third consecutive week and reaching the highest levels since April 2022. Additionally, the USDJPY increased to 141.5 Yen on Friday.

Oil and Gold traded opposite towards the end of the week

Gold started the week lower due to caution ahead of upcoming U.S. consumer inflation data and a Federal Reserve meeting. However, Gold traded lower at the end of the week as bond yields moved higher. Prices of Oil moved lower at the start of the week as the unpredictability concerning the United States Federal Reserve’s latest decision on interest rates scheduled for this week seemingly discouraged investors. However, at the end of the week oil moved higher, as higher Chinese demand and OPEC+ supply cuts lifted prices, despite an expected weakness in the global economy and the prospect for further interest rate hikes. Meanwhile, the Crude Oil Inventories report will be released on Wednesday which is expected to show a decrease of 6.046M.

Stock indices performance

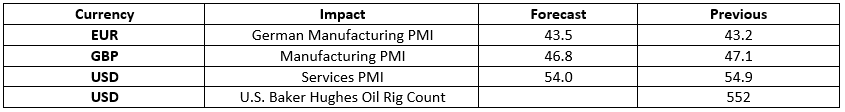

Key weekly events:

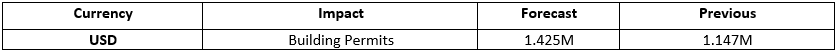

Tuesday – 20 June 2023

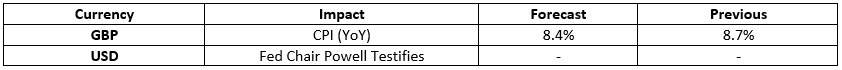

Wednesday – 21 May 2023

Thursday – 22 June 2023

Friday – 23 June 2023

Sources:

https://www.tradingview.com/